Difference between revisions of "Practice questions"

Jump to navigation

Jump to search

Kevin Dunn (talk | contribs) |

Kevin Dunn (talk | contribs) |

||

| Line 1: | Line 1: | ||

These are questions from previous years' exams and midterms. They do not reflect the questions I will ask, but should be suitable for practice. Many practice problems are available in the [[Engineering_economics_-_2012|textbooks for the economics section]] of the course. | These are questions from previous years' exams and midterms. They do not reflect the questions I will ask, but should be suitable for practice. Many practice problems are available in the [[Engineering_economics_-_2012|textbooks for the economics section]] of the course. | ||

;Question 1 | ;Question 1 | ||

:A small aerospace company is evaluating two alternatives: the purchase of an automatically fed machine or a manually fed machine. All projects in the company are expected to return at least 10% (before tax). The auto-fed machine has an initial cost of $23,000, an estimated salvage value of $4000 and a predicted life of ten years. The expected production rate is 8 tons per hour, and the operating costs are $12 per hour. The annual maintenance cost is expected to be $3500. | |||

:The manually fed machine has a purchase price of $8000, $0 salvage value, a 5-year life and a production rate 6 tons per hour. The operating costs are $24 per hour, and the annual maintenance cost is $1500. Some additional information: | |||

:# Both machines produce product using the same feed material and energy, and they both produce products with the same value. | :# Both machines produce product using the same feed material and energy, and they both produce products with the same value. | ||

:# There is no delay between ordering the machine and placing it in operation. | :# There is no delay between ordering the machine and placing it in operation. | ||

:# We assume that the production (ton/year) will be the same every year | :# We assume that the production (ton/year) will be the same every year | ||

:# The project has a ten-year life. | :# The project has a ten-year life. | ||

:How many tons per year must be produced in order to justify the higher purchase cost of the auto-fed machine? You may analyze this problem using a before tax approach (without considering taxes or depreciation). | :How many tons per year must be produced in order to justify the higher purchase cost of the auto-fed machine? You may analyze this problem using a before tax approach (without considering taxes or depreciation). | ||

;Question 2 | ;Question 2 | ||

:Generally, straight-line depreciation is more | :Generally, straight-line depreciation is more favourable to the company than double declining balance. Answer this question and concisely explain your answer. | ||

;Question 3 | ;Question 3 | ||

| Line 45: | Line 49: | ||

;Question 8 | ;Question 8 | ||

:Many questions on the Safety topic in the course are available in the chapter written by Dr. Thomas Marlin, [http://learnche.mcmaster.ca/media/mcmaster/T4-Safety.pdf available on the course website]. | :Many questions on the Safety topic in the course are available in the chapter written by Dr. Thomas Marlin, [http://learnche.mcmaster.ca/media/mcmaster/T4-Safety.pdf available on the course website]. | ||

;Question 9 | ;Question 9 | ||

:''Final exam, 2003'' | :''Final exam, 2003'' | ||

:You have been asked to evaluate the profitability for installing an oxygen analyzer on a boiler. You have collected the following information. Any other values that you need you must estimate based on your experience in the course; please state all assumptions clearly. | :You have been asked to evaluate the profitability for installing an oxygen analyzer on a boiler. You have collected the following information. Any other values that you need you must estimate based on your experience in the course; please state all assumptions clearly. | ||

:* Analyzer capital cost including installation = $20,000 | :* Analyzer capital cost including installation = $20,000 | ||

:* Analyzer maintenance cost = $4000/year | :* Analyzer maintenance cost = $4000/year | ||

:* Benefit due to reduced fuel cost = $8500/year | :* Benefit due to reduced fuel cost = $8500/year | ||

:You can depreciate the analyzer over a 5-year life using the declining balance method. The analyzer has an expected serviceable life of 10 years without replacement. | :You can depreciate the analyzer over a 5-year life using the declining balance method. The analyzer has an expected serviceable life of 10 years without replacement. | ||

:The boiler will be operated for the next 8 years, after which it will be shutdown permanently. | :The boiler will be operated for the next 8 years, after which it will be shutdown permanently. | ||

:The company is located in Ontario, Canada, and is profitable and expects to be so for all future years. | :The company is located in Ontario, Canada, and is profitable and expects to be so for all future years. | ||

:It is January 2, 2004. If your analysis concludes that the project is financially attractive, the equipment can be installed and put in service immediately (the operators are available and the equipment is in stock at the local suppliers). | :It is January 2, 2004. If your analysis concludes that the project is financially attractive, the equipment can be installed and put in service immediately (the operators are available and the equipment is in stock at the local suppliers). | ||

:Note, most (16) points will be given for a clear, correct formulation of the problem. The calculations should be deferred until the end of the exam, when you are sure that you have completed the other questions. | :Note, most (16) points will be given for a clear, correct formulation of the problem. The calculations should be deferred until the end of the exam, when you are sure that you have completed the other questions. | ||

Latest revision as of 20:12, 25 January 2017

These are questions from previous years' exams and midterms. They do not reflect the questions I will ask, but should be suitable for practice. Many practice problems are available in the textbooks for the economics section of the course.

- Question 1

- A small aerospace company is evaluating two alternatives: the purchase of an automatically fed machine or a manually fed machine. All projects in the company are expected to return at least 10% (before tax). The auto-fed machine has an initial cost of $23,000, an estimated salvage value of $4000 and a predicted life of ten years. The expected production rate is 8 tons per hour, and the operating costs are $12 per hour. The annual maintenance cost is expected to be $3500.

- The manually fed machine has a purchase price of $8000, $0 salvage value, a 5-year life and a production rate 6 tons per hour. The operating costs are $24 per hour, and the annual maintenance cost is $1500. Some additional information:

- Both machines produce product using the same feed material and energy, and they both produce products with the same value.

- There is no delay between ordering the machine and placing it in operation.

- We assume that the production (ton/year) will be the same every year

- The project has a ten-year life.

- How many tons per year must be produced in order to justify the higher purchase cost of the auto-fed machine? You may analyze this problem using a before tax approach (without considering taxes or depreciation).

- Question 2

- Generally, straight-line depreciation is more favourable to the company than double declining balance. Answer this question and concisely explain your answer.

- Question 3

- What are typical critical values for Payback Time (PT), Return on Original Investment (ROI), and Discounted Cash Flow (DCF). The critical values define the boundary between an attractive and unattractive project.

- Question 4

- For each of the investments given in the following, determine whether they can be depreciated completely in the year of there first use (expensed), depreciated over many years (as defined by tax laws) or not depreciated. All have been acquired for a profit-making company. State your answer with a short discussion for each part.

- A personal computer

- Land for a plant

- Laboratory glassware with a life of 9 months

- Liquid inventory needed to start up and operate a chemical plant

- Question 5

- Give four quantitative methods for evaluating financial attractiveness. For each, provide the following.

- A brief explanation/definition

- One advantage

- One disadvantage

- Explain briefly how each measure is used to decide whether to invest or not. You must give a typical threshold value.

- Question 6

- Your company is establishing a new office in Calgary. You seem to be spending a lot of money. One of your co-workers says, “Don’t worry, we can depreciate the costs.”

- Describe the key characteristics of costs that can be depreciated.

- Explain how you determine the rate with which a specific cost is depreciated.

- Question 7

- Estimate the current Total Module cost to install a mixer-settler unit with six stages including interconnecting piping and pumps. The aqueous to oil ratio A:O is 1:1. The flow of aqueous feed to each unit is 9 L/s. All the units are to be rubber lined. The cost is to include nozzles and internals. The costs of tankage and crude removal are excluded.

- Question 8

- Many questions on the Safety topic in the course are available in the chapter written by Dr. Thomas Marlin, available on the course website.

- Question 9

- Final exam, 2003

- You have been asked to evaluate the profitability for installing an oxygen analyzer on a boiler. You have collected the following information. Any other values that you need you must estimate based on your experience in the course; please state all assumptions clearly.

- Analyzer capital cost including installation = $20,000 :* Analyzer maintenance cost = $4000/year

- Benefit due to reduced fuel cost = $8500/year

- You can depreciate the analyzer over a 5-year life using the declining balance method. The analyzer has an expected serviceable life of 10 years without replacement.

- The boiler will be operated for the next 8 years, after which it will be shutdown permanently.

- The company is located in Ontario, Canada, and is profitable and expects to be so for all future years.

- It is January 2, 2004. If your analysis concludes that the project is financially attractive, the equipment can be installed and put in service immediately (the operators are available and the equipment is in stock at the local suppliers).

- Note, most (16) points will be given for a clear, correct formulation of the problem. The calculations should be deferred until the end of the exam, when you are sure that you have completed the other questions.

- Question 10 (troubleshooting)

- Final exam, 2002

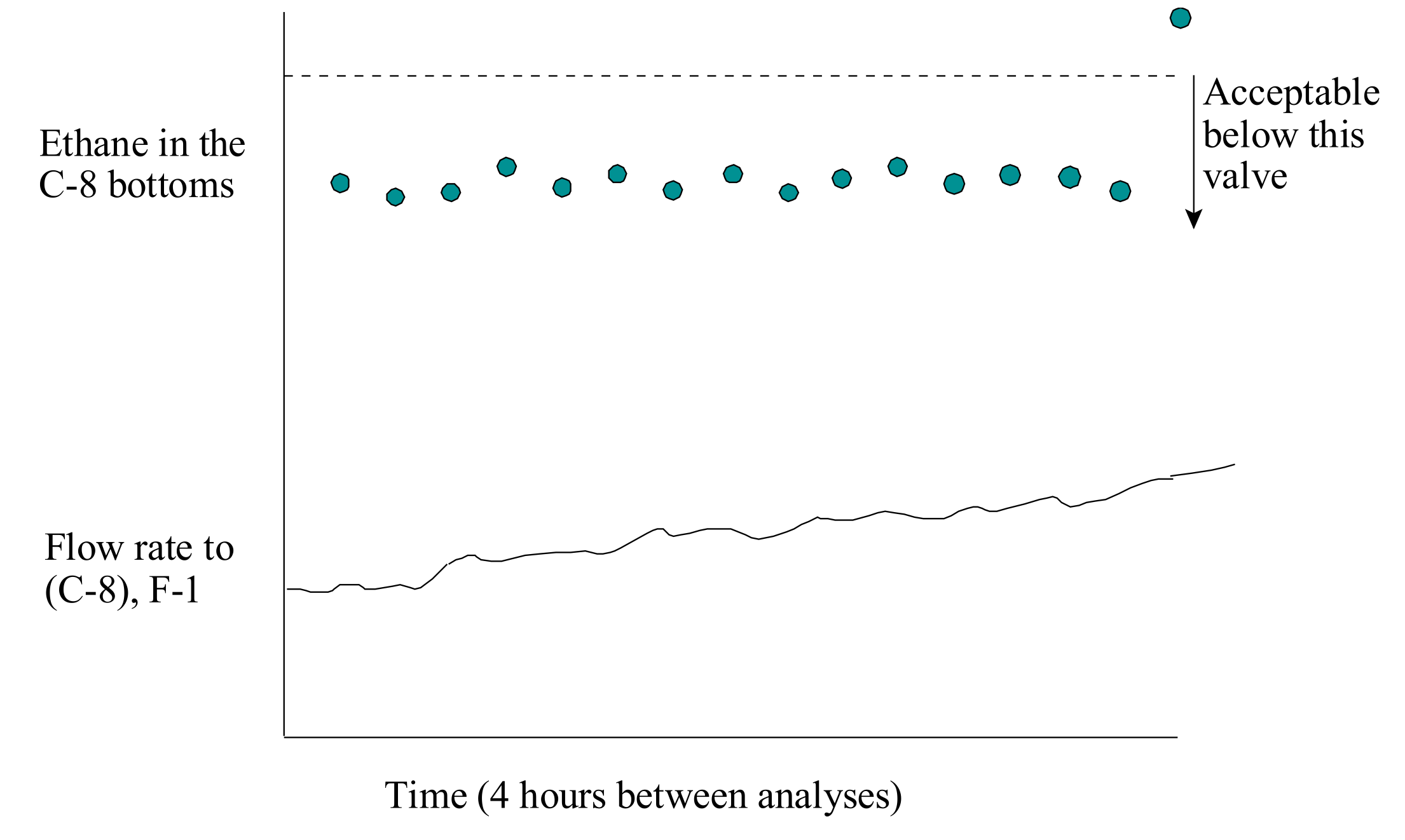

- The following trouble shooting scenario is provided for the distillation process in the figure that was used in Assignment 7, the depropanizer column.

- The plant has been operating well for the last few weeks. One of your competitors has been having equipment outages; therefore, you have been able to increase your production rate and sales. Things have been going great! Then, the operator calls you to let you know that the laboratory analysis of the depropanizer (C-8) bottoms product contains too high a mole fraction of ethane. Your customer will not accept the propane product with this ethane concentration. When you arrive at the control center the operator shows you the historical data in the figure below. You better solve this problem!

- You are not expected to completely solve this problem during the examination. Your answer must contain complete written documentation of your trouble shooting procedure.

- Specifically, your answer must contain (but is not limited to) the following:

- At least four hypotheses for the cause of the trouble.

- At least four actions that would be useful in eliminating incorrect hypotheses and reducing to one hypothesis. These should be clearly stated and presented in the order you would request them in the plant.

- An explanation of how you would use the feedback plant data for each action. For example, "If ___ and ___ are at their normal values, then, I would conclude the hypothesis #2 is disproved because ______"

- Question 11

- These questions refer to the flowsheet from Assignment 7. Some rules of thumb to help:

- One atmosphere is equivalent to about 10 meters of water (33 feet)

- Trays in a distillation column are usually 1 foot apart (30cm)

- The figure shows that tower C-8 must be a minimum of 3m above ground level. However, no pump is shown in the line from the bottom of C-8 to C-9. Is this a mistake?

- Tower C-9 is expected to operate at many different production rates, product purities, ambient conditions, etc. Describe the operating conditions that you would use to "size" the exchanger used as the heat exchanger (E-28). By "size", we mean calculating the area for heat transfer. Be specific about the operating conditions. You do not have to give numeric values, but you can explain the extreme value (maximum or minimum) that you select for each variable and why.

- What is the purpose of measuring differential pressures along a distillation column?

- A colleague suggests that the safety relief valve at the top of C-8 (PSV-1) be replaced with a burst diaphragm. What is your response and why?

- Question 12

- You are one of the few people in your group who knows anything about HAZOP. The chief engineer, Sue, asks you to develop a day-long training program to introduce HAZOP to all of the 15 engineers in the engineering department. You suggest that process operators should also understand the approach because their input can be invaluable. Sue suggests that you have a planning meeting to develop the training program. At the meeting she suggests you include

- Sarah, an electrical engineer (2 years at McChem Inc.)

- Ken, a chemical engineer (32 years);

- Phil, process operator (15 years of operating experience and now shift supervisor);

- Xionan, an operator;

- Danielle, Union representative

- Sue, chief engineer.

- The meeting is to be in the conference room, 8:00 to 10:30 am one week from now. Create the agenda.

- Question 13 (troubleshooting)

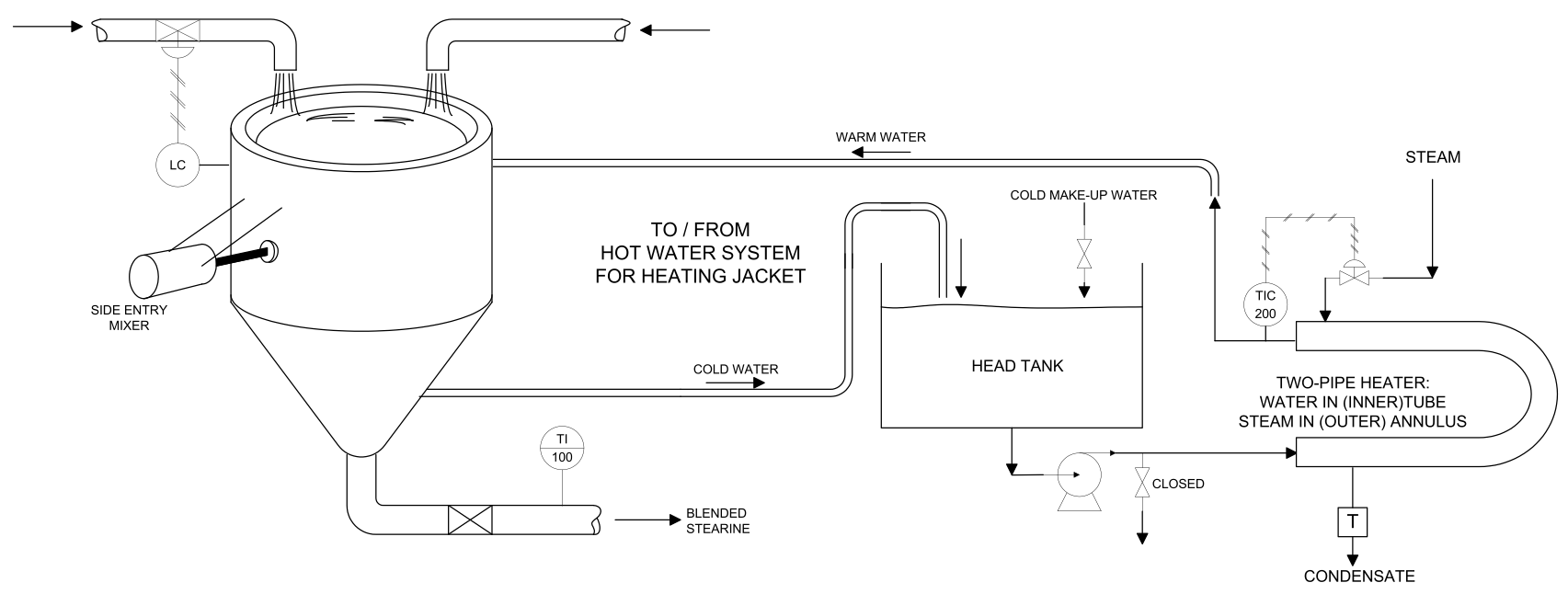

- Stearine is blended in a 15-ton tank to obtain uniformity of product and to bring it to a uniform temperature 2 to 3K above its freezing point. Both steps make downstream processing easy and contributes to good product quality. The blender handles 20 tons every 24 hours. Specification grade stearine sells for 16 cents per pound, whereas stearine that is off specification is worth nothing. A sketch of the blender is given in the figure below.

- Due to a problem with a supplier, production has been cut back to half of the normal rate for the past two days, and it looks as though it will be like this for another couple of weeks. Unfortunately, since the lower production rate started, the stearine leaving the blender has gone off specification. Your boss comes into your office and exclaims "Get this plant going correctly, or you will pay for this out of your salary!", "Can he really do that?" you ask yourself. Better not take the chance; let's get it fixed right away!

- You are not expected to completely solve this problem during the examination. Your answer must address the following issues. No other parts of the troubleshooting procedure are required for this examination. (You will certainly have to "explore"; you do not have to document this.)

- The define step.

- Give at least four hypotheses for the cause of the trouble.

- Give at least four diagnostic actions that would be useful in eliminating incorrect hypotheses and reducing to one correct hypothesis. Your actions should be clearly stated and numbered in the order you would perform them in the plant. Explain which hypotheses are tested with each action.

- Question 14 (ethics)

- Plenty of practice problems available here.