| Class date(s):

|

11 September onwards

|

|

|

|

|

| Download video: Link [113 M]

|

|

|

|

|

|

|

|

|

| Download video: Link [109 M]

|

|

|

|

|

|

|

|

|

| Download video: Link [122 M]

|

|

|

|

|

|

|

|

|

| Download video: Link [110 M]

|

|

|

|

|

|

|

|

|

| Download video: Link [118 M]

|

|

|

|

|

|

|

|

|

| Download video: Link [113 M]

|

|

|

|

|

|

|

|

|

| Download video: Link [111 M]

|

|

|

|

|

|

|

|

|

Selected references

The following printed materials have influenced the course content. In alphabetical order:

| Author(s)

|

Title

|

Library link

|

Google search for ISBN

|

Amazon link for ISBN

|

| Blank and Tarquin

|

Engineering Economy (7th edition, or earlier)

|

McMaster

|

Google

|

Amazon

|

| Fraser et al.

|

Engineering Economics in Canada (3rd edition, or earlier)

|

McMaster

|

Google

|

Amazon

|

| Fraser et al.

|

Global Engineering Economics (4th edition, or earlier)

|

McMaster

|

Google

|

Amazon

|

| Park, Zuo and Pelot

|

Contemporary Engineering Economics, a Canadian perspective (3rd edition, or earlier)

|

McMaster

|

Google

|

NA

|

| Stermole and Stermole

|

Economic Evaluation and Investment Decision Methods (13th edition, or earlier)

|

NA

|

Google

|

Amazon

|

| Turton et al.

|

Analysis, Synthesis and Design of Chemical Processes (4th edition, or earlier)

|

McMaster

|

Google

|

Amazon

|

Class slides

The slides are in tab 3 of the notes.

11 September 2012

In this class we give an overview of the "Engineering Economics" section of the course. We start by introducing the topic of the time-value of money.

13 September 2012

We continue considering the time value of money (TVM) and do some class exercises.

- Slides: We cover slides 24 to 29. Slides 30 and 31 will feature in the next tutorial.

- Audio and video recording of the class

14 September 2012

- We wrap up the TVM section with one more example and then continue looking at Measures of Profitability: slides 32 to 42

- Audio and video (bad sound!)

18 September 2012

- We continue with various Measures of Profitability: slides 42 to 48

- Audio and video recording of the class

20 September 2012

- We will wrap up Measures of Profitability (slides 49 to 54); including jumping ahead to slides 88 to 90.

- If you are looking for some more information regarding NPV vs DCFRR, please read this tutorial, or use this Google search to understand the subtleties.

- Audio and video recording of the class

21 September 2012

- We will cover Depreciation, slide 63 to 80.

- Audio and video recording of the class

- Here are the websites used in today's class if you want more information on CRA's rules on depreciation (called Capital Cost Allowance, CCA):

25 September 2012

- We will (re)cover the effect of depreciation and taxes on NPV, slides 78 to 83 and go through the tutorial/assignment 3. We will also discuss the SDL project selection procedure.

- Audio and video recording of the class

- Please see this PDF slide 80 from the course notes. Note the following relationships:

- = this is the line we use for our NPV calculation

- Important note: I've assumed that expenses are entered as positive numbers. This allows me to write, for example, . If you use negative signs in front of your dollars, which is what the spreadsheet in the course notes does, then adjust these formulas.

27 September 2012

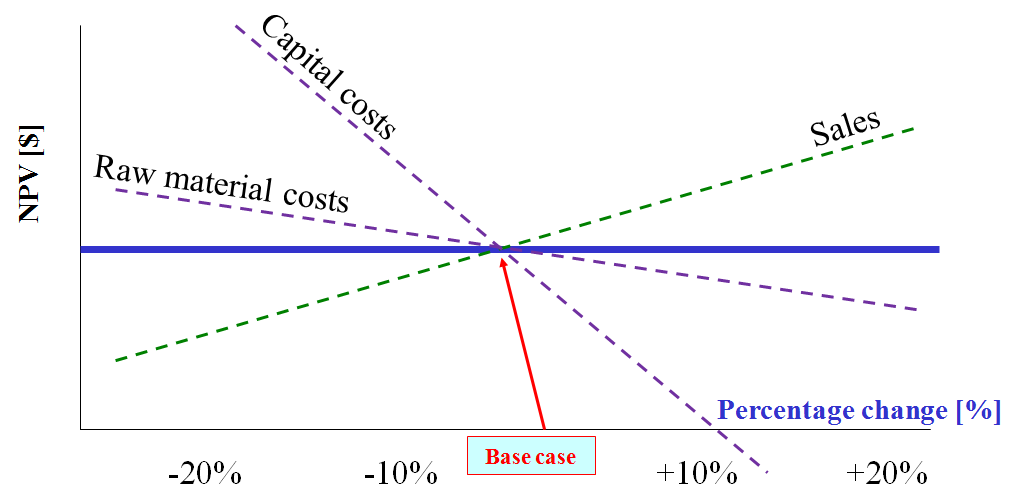

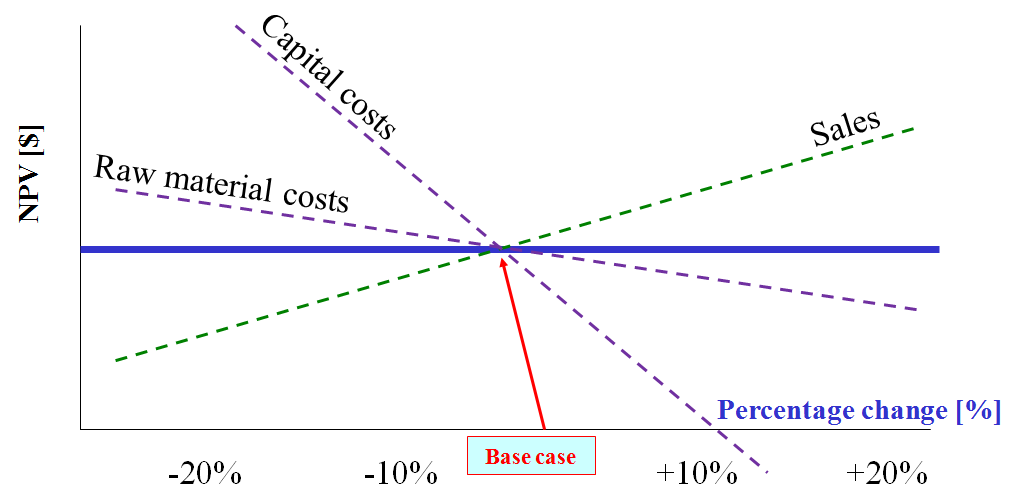

- We will cover sensitivity analysis on an NPV, slides 104 to 115

- Audio and video recording of the class

- The publication by Adams and Barton with NPV for polygeneration.

- An alternative way to visualize sensitivity analysis data shown in class:

28 September 2012